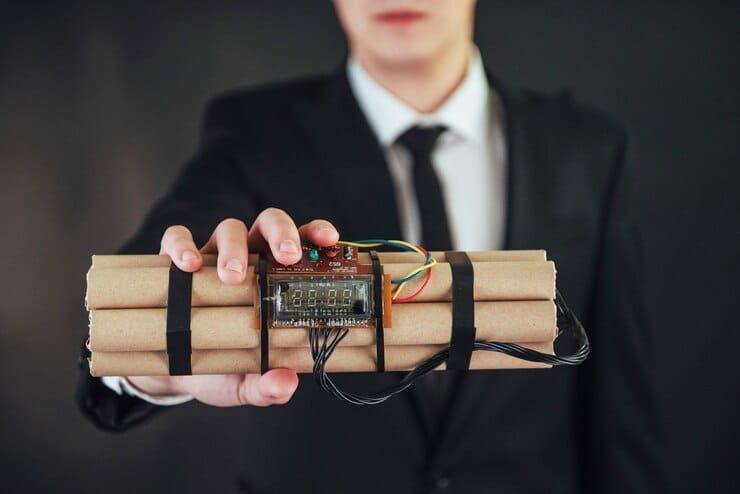

Overview: The Ticking Time Bomb of Your Professional Liability Insurance

We are training you with data until October 2023. As industry professionals and business thought leaders, you are redefining limits, traversing multifaceted jungles, and advocating for the best and the brightest. However, such great advancements are not without their own risks, which is exactly where your professional liability insurance comes into play – a key element of your safety net, a protective barrier against unpredictable storms. We welcome you, the makers of change, the creators of the future. You are not only selling a product or service, you are building trust, creating connections and transforming industries. But are you certain that the foundation on which you develop on is stable?

“The best time to plant a tree was 20 years ago. The second best time is now.” When it comes to professional liability coverage this time honored proverb definitely rings true. We see the brilliant business walking a tightrope without even knowing it too often, the business policy potentially not being good enough, leaving them open to severe financial and reputational damage. Indeed, your professional liability policy is not set in stone; it is a dynamic agreement that should evolve in parallel with your destination in the world facing our business. It’s about proactively making sure you’re not only covered then; you’re empowered.”

This post is not to instill panic; it is an encouragement to take back control. Its like the reassuring hand walking you through your professional liability insurance so it’s not a ticking time bomb that will explode, but rather a hardy defense, a firm ground that enables you to go ahead and live your dreams. We’ll delve into areas that are seldom given enough attention, impart on you actionable advice and strategies, and encourage you to think of your insurance as a springboard to growth and stability. Lets journey towards a better future where you’re not just covered, but truly secure, and you can do what you do best – leaving your mark in this world.

Positive Trends: Catalysts for Growth and Innovation

1.Heightened Scrutiny and Demand: The digital age ushered in an era of greater scrutiny and accountability. Encouraged by professionals’ awareness of their exposure to lawsuits, they are seeking for professional liability coverage benevolence. Consider the boom in telehealth — doctors now have the potential for liabilities across state lines, a lack of comprehensive policies driving the market. This allows to build a more dynamic and engaged customer segment.

- The takeaway: Insurers should be developing targeted marketing campaigns to help professionals understand their specific risks and the policies available to properly mitigate those risks. This is a chance to develop strong customer connections based on trust.

2.Technological Revolution: From AI-driven automation to Paperless approaches, Insurtech is digitizing insurance processes—ensuring transparency and expeditious processing. With the strength of Insurtech, imagine a situation, an architect can get a quote based on live project data in a matter of minutes. This makes things more efficient, reduces costs, and encourages transparency.

- Takeaway: Insurtech integration can boost underwriting, claims processing, and customer service It’s not merely about keeping up, but gaining a competitive advantage.

3.These are some niche market opportunities due to demand for increasingly specialist coverage because of professional specialization. Take the cybersecurity consultant — their specialized knowledge leads to specialized liabilities and a need for customized insurance offerings. This creates opportunities for targeted growth and product innovation.

- Hit Business Idea: Create and develop policies for niche professions Be the provider of solutions for underserved markets.

Adverse Trends: Challenges that Demand Proactive Strategies

1.New Evolution of Risk: The fast pace of technology evolution introduces new risks. By way of example, underlying AI bias or data breach can create unforeseen liabilities for tech professionals. Handling cyber security proactively vs reactively pays offCompanies that leave it too late tend to react rather than proactively approach cyber security. Resulting in greater potential damage to client data. It requires constant follow-up and adjustment.

- Actionable Insight: Make large investments on risk modeling and research on emerging liabilities. Collaborate with experts that will guarantee that your policies are sound and that you can make adjustments based on the evolving environment.

2. Rising litigation costs: The cost to litigate is becoming exorbitantly expensive, along with complex legal fights which create strain on insurers. The cost of settlement for lawsuits is high, and one small mistake can cost you the fortune. This can affect profitability and the cost of policies.

- Actionable Takeaway: Provide resources to policy holders that help them prevent risk of being sued. Engage legal specialists to create cost-effective strategies for managing the claims process.”

3.Competition and Market Disruption: Industry fragmentation and the emergence of technology platforms are fueling competitive pressure. Price wars erode profit margins, and entrenched brands have to put more effort to hold on to customers. It requires innovation and customer-oriented approaches

- Takeaway: Retain loyalty through proactive customer service, transparency, and value-added offerings beyond the policy. Adopt a ‘customer-first’ mentality.

Final Thoughts & Call to Action

As Winston Churchill so wisely once said “To improve is to change; to be perfect is to change often.” The professional liability insurance market can be unpredictable, and the forces of change are inevitable. We can see these shifts as not threatening our business but providing an opportunity to innovate, grow and serve our customers more effectively. We will not just survive these changes, but thrive in this exciting market by embracing technological advancements, supporting new risks when they arise and putting the customer at the center of everything we do. Let us meet the challenge with courage and optimism and the spirit of innovation!

In Healthcare, consider a surgeon who does everything right, but then they experience a highly unlikely complication in a procedure, and now a patient has a lifetime health problem. This is the moment where professional liability insurance comes into play, it protects the surgeon from bankruptcy, covering the costs of legal defense and potential settlements, allowing him to heal and learn from the situation instead of worrying how to pay the next deposit. “If you want to predict your future, create it,” which is exactly what this insurance enables the medical professionals to do, innovate and save lives without fear of the unexpected.

In-texts Related to Tech Industry: A software development firm launches a new platform for one of its clients. An essential bug allows data leaks which become a financial nightmare for the customer. A tech company with a growing professional liability policy has you covered and knows that the financial backstop to address losses and navigate any ensuing legal and PR complexities puts your client in a position to learn from the experience and build back stronger. If we have learned anything in history, it is that great works are born from passion and love: “The only way to do great work is to love what you do,” which means this insurance allows tech pioneers to work on their visions with zest, making it clear that failure is part of the innovation process.

Consider the example of an automotive safety design failure by an engineering company that results in car recalls and personal injuries. Their professional liability insurance protects them from the overwhelming claims that would arise in a scenario like this. In this scenario, they are able to fix the design and rebuild trust rather than be ruined. “Believe you can and you’re halfway there” – this type of insurance acts as a bridge that enables companies to get back on their feet from adversity and builds courage to keep pushing forward.

For example, in the manufacturing sector, a product design firm might invent an exciting new piece of industrial machinery for a client. Little do they know that, due to a specification misfire, they are causing plant downtime for their client and will be responsible for the losses. Professional liability insurance to the rescue, allowing the firm to pay the costs and correct the design. “Challenges are what makes life interesting. And overcoming them is what gives them meaning.’” – This coverage gives businesses the confidence to embrace challenges head-on, reassured they have the coverage they need to learn, improve, and innovate.

I should note, for all industries, this isn’t just a policy, but a shield of sorts guarding the very heart of innovation and entrepreneurship. It’s about the courage to take risks when you know you’re not alone. “It’s about building a safety net — so that businesses can keep learning and growing and succeeding.” So take advantage, take risks, and keep in mind: “Success is not final, failure is not fatal: It is the courage to continue that counts.” Please select wisely and plan the future of tomorrow.

Organic Growth Strategies:

- A key change is the growing emphasis on niche markets and customized products. I remember speaking with a broker who wrote tech startups and they always cursed the “one-size-fits-all” policies. Now, we are starting to see insurers taking a proactive approach and creating bespoke coverage for things like AI development, renewable energy consulting, and even cybersecurity firms. They’re not only selling insurance, they’re selling solutions that are recognizing those unique risks. This is the deep-blues of risk profiling, modular policies that can be man-tied on demand for the pot.

- A further large scale natural strategy is digital platforms and data analytics investments. Say goodbye to mountains of paperwork. Now it’s streamlined online applications, automated claims processing and using data to better predict and prevent losses. A company I’m familiar with recently launched a new platform that enables quick quoting, as well as real-time risk assessment and educational resources for clients. That means policy holders are better educated, and insurance companies can fine-tune their underwriting.

Inorganic Growth Strategies:

- We are also seeing strategic acquisitions to broaden market reach and expertise. A nimble, smaller insurer may acquire a broker with a stronghold in a sector expected to experience significant (high) growth, and immediately gain a critical presence and expertise in that market. This is quicker than if you were to build it from nothing. Like one big insurance group, which bought a technology platform focused on data analysis for cyber risk, enabling them to release new and exciting products.

- Lastly, partnerships are becoming more and more important. It’s not just about mergers. I was in attendance at a recent conference where a number of insurers were discussing their plans of working with tech companies or cyber security specialists to deliver a bundled service. Imagine a law firm obtains a professional liability policy that also provides access to a round-the-clock data breach response team. That’s a win-win, broadening the offering and also providing additional stickiness with clients and a holistic value-add aside from a piece of paper.

Outlook & Summary: Navigating the Future of Professional Liability – A Lighthouse in the Storm

The professional liability landscape is ever-evolving, and while some may view a “ticking time bomb,” we see a canvas of opportunity. We expect major changes over the next 5-10 years due to technology, changing client expectations and a more global marketplace. Like the broader liability insurance market has adapted and flourished in the face of challenges, so can professional liability. The words of Helen Keller come to mind: “Optimism is the faith that leads to achievement. Without hope and confidence, nothing can be done.” This is not a time for fear, but for proactive adaptation. We expect to see even more focus on risk management solutions, customized coverage options, and playing a greater role for technology in underwriting and claims management.

Nothing Less Then Should be Your Approach, Taking Care Of Your Needs For Business Insurance: The Best Professional Ancillary and General Liability Insurance Companies You Should Choose. Just as a well-kept vessel can ride any tempest, we know that businesses with proper exposure and preventive methodologies will not only endure but flourish within this shifting backdrop. We invite you to consider your insurance policy as a strategic enabler and operative facilitator, dancing between risk management and proactive innovation on your path forward This is your opportunity to take charge, to actually manage risk, and to create a more robust tomorrow. It’s not security, it’s empowerment.

So, as you consider this journey that we started, what are the actions you will take today to make your professional liability coverage your greatest asset and not your greatest concern?