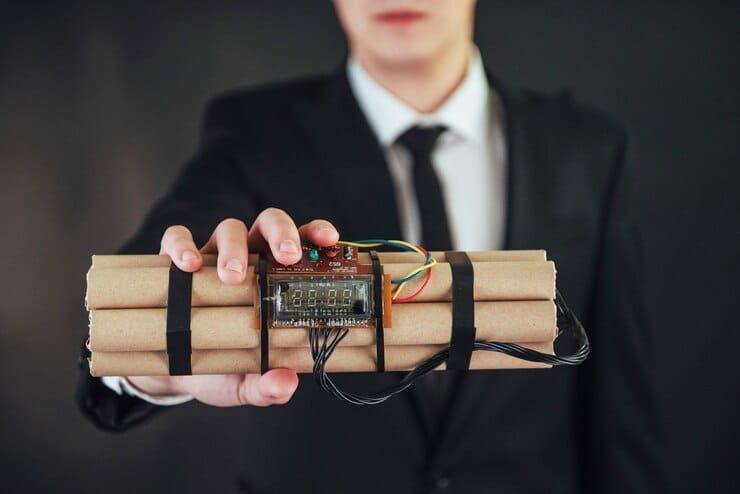

Overview: Is Your Board’s Liability Insurance a Ticking Time Bomb?

Directors and Officers (D&O) liability insurance is more complex than ever. It is no longer just a simple check-the-box exercise. It could be that your board’s insurance is hanging by a thread — or even a ticking time bomb — in today’s environment treated by regulators with greater scrutiny, that has an increasingly litigious shareholder base and with a fast-paced, constantly evolving landscape of business. A seemingly adequate paper policy could end up leaving you and your organization facing significant risk when a claim is made against you. So, understanding and managing your D&O insurance is more important than ever.

This post is here to help walk you through an essential process: assessing the adequacy of your current D&O coverage and the steps that you can take to minimize any weaknesses. We’ll do this step-by-step:

- The current D&O landscape: Why D&O claims are increasing, what triggers are driving up the volume of lawsuits and settlements. Consider this the lay of the land before entering the battlefield.

- Next, we’ll dive into the main components of your policy: We’ll break it down (in plain English!) what to consider, how various clauses function, and common traps that could leave you underinsured. We’ll help you decipher tricky terms and uncover holes in your present coverage.

- Next, we’ll take you through a more hands-on review process. We’ll provide specific questions to pose to your broker or insurer, and steps you can take to shore up your protection. This will help you out transform the policy from being a threat into a shield. (This is like fine-tuning a safety net step!)

- Finally, we’ll get into best practices for ongoing risk mitigation: We’ll consider the role of your policy and look beyond it to discuss steps your board can take early to minimize the chances of claims arising at all. This method addresses the cause rather than the symptoms.

By the end of this post, you will be prepared to evaluate your board’s liability insurance with confidence, ensuring it is providing you the protection you need for today’s challenging environment. Don’t wait until time’s up — let’s review your coverage today.

Corporate Governance and the D&O Market

D&O insurance safeguards directors and officers of the company from personal losses due to suits and other legal actions brought against them for acts performed as part of their duties for the company. It has a complex system that encompasses legal, economic, and societal dynamics.

The Key Trends in the D&O Market

Here’s a roundup of current trends, sorted for readability:

1.Positive Trends

- Trend 1: Increasing Awareness & Demand: Organizations, particularly startups and those in tightly regulated industries, are growing more cognizant of D&O risks. This is driven by increased scrutiny from regulators, investors and the public. Effect: Policy sales have increased, and the market has grown.

- Trend 2: Technology & Data Analytics: Insurtech companies are using data analytics to enable them to more accurately evaluate D&O risks and to develop customized and more efficient policies. This includes AI based risk models and claims ore processing. Impact: Improved cost estimation, quicker claim settlement, and innovative products.

- Trend 3: Evolving ESG (Environmental, Social, Governance) Focus: There is a growing scrutiny on companies about their ESG practices. That translates into possible D&O claims on the greenwashing, diversity issues or ethical lapses front, driving the need for specialized coverage. Impact: New lines of products on ESG-related risks; expansion of market segments where ESG is relevant.

2. Adverse Trends

- Trend 4: Increasing Litigation and Claim Severity: D&O lawsuit filings — especially securities class actions — are increasing in number and cost as economic uncertainty and regulatory crackdowns persist. Effect: Increased premiums and stricter underwriting standards, which could make coverage less available to some companies.

- Trend 5: Geopolitical Instability & Cyber Threats: Broader global events, like the disruption of supply chains and cyberattacks, are divergent opportunities for potential D&O claims. As a result, directors are supposed to have solid risk management plans — or risk liability when things go awry. Read more: Commonly 1970s, go on for several weeks, and then relax it after.

- Trend 6: Talent Gap & Employee Related Claims: As talent management takes the lead D&O policies are subjected to more claims related to wrongful termination and discrimination or harassment. There is a challenge at attracting new talent to the market as some of the older professionals retire. Effect: Careful evaluation of HR policies, required specialized coverage for employee-related risks, need of new talent entering the insurance market.

The D&O Market Business Takeaways & Practical Solutions

Leveraging Positive Trends:

- Trend 1: Educate and Market: Increased focus on educational campaigns to drive awareness of D&O risks across under-covered sectors. Engage in targeted marketing strategies to meet specific needs, such as startups, or industries under increased regulatory scrutiny.

- Trend 2: Technology Investments: Use AI and data analytics to improve risk modeling, underwriting, claims handling This has helped in driving efficiency as well as accuracy of pricing, lowering overhead, improved speed of claims and more importantly, better customer experience.

- Trend 3: Create Tailor-Made Products: Design bespoke coverage options that primarily target ESG points of exposure in your organization. Develop expertise, then tell your clients about new areas of risk they may not know about.

Mitigating Adverse Trends:

- Trend 4: Improve Risk Assessment: Create advanced risk assessment tools to pinpoint companies likely to face litigation We write a wide diversity of policy types to spread across all risks.

- Trend 5: Evolve Geopolitical & Cyber Risk: Provide cyber and other risk assessments to clients. Be clear on exclusions. Develop specialized offerings on emerging risk areas and engage with others for holistic solutions.

- Trend 6: Provide Services in HR domain: Help clients learn about HR risks. Help them create thorough HR policies. Development of employee related claims coverage options Have a plan to grow the D&O market by attracting new talent.

Conclusion:

The D&O landscape is fluid and riddled with both challenges and opportunities. These trends varied from internal factors to external ones and by predicting such — and being aware of the risk factors your clients have — businesses can successfully manoeuvre through the market and secure a competitive edge leading to sustainable growth.

- Health Care: A hospital system is hit with a class-action suit claiming the board didn’t put adequate data protections in place, resulting in a huge compromise of patient data. The D&O policy covers the legal defense costs as well as any settlement or judgment. This is an example of how D&O shields directors from liabilities related to oversight failures.

- Technology: The chief executive of a tech startup is a little too optimistic about its revenue prospects in an investor pitch. When the company underperform by a wide margin against these targets, investors sue the CEO and board for misrepresentation and securities fraud. D&O insurance covers the legal defense team, and any monetary judgments that follow, shielding the leadership’s personal assets. This illustrates how D&O protects against risks associated with inaccurate or misleading statements.

- Automotive: Shareholder oppose a top car maker board of directors for hiding critical information about a ”defect” in one of their vehicle type the cause of several accidents & injuries The D&O policy covers the enormous legal fees, settlement costs with the shareholders, and costs incurred for any reputational damage control. This shows the difference D&O makes in cases where directors are accused of corporate negligence and failure to make use of crucial information.

- Manufacturing 👷: A manufacturing firm is hit with a wave of layoffs after it becomes publicly known that they violated environmental regulations. The board of directors is sued by shareholder groups for non-compliance with environmental regulations and for mismanagement of the company’s resources. Even if the company wins the lawsuit, the legal costs of defending themselves against such suits — and the chance of losing a case — could add up to high sums and D&O would help cover those costs.]

- Financial Services: The directors and officers of a bank are sued by regulators alleging that the directors and officers failed to properly oversee a complicated investment portfolio, causing the bank and its clients to suffer massive losses. In this case, the D&O policy steps in to pay for the legal representation, fines, and damages that are paid to the regulatory bodies. This is a great example of why financial institutions need D&O insurance, as decisions can have profound financial consequences.

For Strategists, this learning helps you analyse your organisations specific exposures in: oversight, compliance, disclosures & corporate negligence, and tailor your D&O policy to account for these. Make sure the policy that is secured has proper limits and covers the areas that are most litigious in your industry.

Advanced Data Analytics & AI Integration:

Insurers are also utilizing advanced data analytics and AI to improve risk assessment. For example, rather than rely exclusively on historical claims data, insurers such as Chubb are incorporating real-time market data, news sentiment analysis, and even social media trends to forecast potential D&O exposures. This enables more accurate underwriting and tailored policy offerings, evolving from one-size-fits-all generalizations to precise, data-driven risk profiles. This and organic strategy yield a competitive advantage through precision pricing.

Niche Product Development for New Risks

Aware of the shifting landscape, the D&O insurers are developing niche products. Think about the emphasis on cyber-related exposures. Companies such as Beazley are crafting policies that explicitly respond to the legal and regulatory ramifications of data breaches or cybersecurity failures, which aren’t fully covered under traditional policies. That means providing “incident response” add-ons, which is an organic reaction to a particular attack.

Why Integrate via Strategic Acquisition of Niche Players:

You can also add inorganic growth. An important insurer could potentially buy a smaller rival focused on D&O coverage of a particular industry, say, tech startups or private equity companies, to gain access quickly to know-how and established distribution networks. For example, a larger insurance group acquired a smaller InsurTech platform that was building technology for D&O insurance. This gives them both technology and a new niche customer base.

New Palate: An Introduction to ESG and Regulatory Compliance

As general attention to environmental, social and governance (ESG) issues increases, insurers are incorporating ESG risk into the underwriting process. That includes evaluating a company’s board diversity and sustainability practices to gauge risk. It’s a well-founded organic growth, through all-natural responses to regulatory developments and client expectations: A few insurers are pioneering discounted insurance programs for businesses that showcase strong ESG performance.

Outlook & Summary: Navigating the D&O Landscape Ahead

Just as with the larger liability insurance market, the world of Directors and Officers (D&O) liability insurance is undergoing sweeping changes. In the next 5 to 10 years, you can expect the following key trends:

- Enhanced Crackdown: Regulators and stakeholders are placing greater scrutiny on corporate governance. This will lead to enhanced scrutiny of D&O policies and potentially, more frequent and complex claims. D&O will likely follow suit — just as general liability insurance is facing a wave of litigation.

- Premiums Go up and Down: The cost of D&O insurance is going to keep bouncing around. Similar to other liability coverage, premiums will adjust based on factors like risk exposure, claims history and carrier profitability. So, stay abreast of these factors that influence price and how they affect policy limits.

- Why Cyber Threats Keep Evolving: Cybersecurity incidents are more than an IT issue. Directors’ and officers’ (D&O) claims due to the alleged negligence or poor risk management arising from data breaches and privacy violations are becoming more prominent. Professional liability coverage has to go through similar evolution to incorporate tech related errors, and so will D&O.

- ESG (Environmental, Social, and Governance) Concerns — Increasing focus on sustainability, diversity, and ethical business practices will lead to increased exposure for directors and officers. Be prepared for more and more claims based on a company’s ESG policy (or lack thereof).

Bottom line: The most critical point for take-away here is that in order to proactively manage your board’s risk and to maintain sufficient D&O insurance coverage. D&O is not a static, “set-it-and-forget-it” policy. Think of it instead as a living instrument, continuously revised to protect the personal holdings of your directors. That will require a watchful eye towards risk management, as well as a solid comprehension of what is included — and excluded — from your D&O policy.

In this evolving environment, do you have confidence that your D&Os coverage will provide sufficient protection for your boardroom against rising risk?